Who Typically Uses Payday Loans?

Last updated on July 30th, 2025 at 09:51 am

Payday loans are typically used by individuals who need quick access to cash due to an unexpected expense or financial emergency. These loans are often chosen by those who may not have access to traditional credit, are in need of fast relief or are struggling to stay financially afloat between paydays.

Among the most common users of payday loans are individuals aged 25 to 35, healthcare workers like nurses and army members, all of whom may face financial challenges that prompt the use of these short term loans. For many, payday loans offer a quick solution to cover urgent bills, car repairs or other emergencies.

Who Uses Payday Loans Most Often?

Payday loans are used across a range of demographics, with certain groups being more likely to rely on them due to specific life circumstances. Some common users include:

- Young adults (25-35 years old): This age group is often just starting their careers and managing multiple financial obligations like rent, student loans and day-to-day living expenses that leave little room for financial flexibility.

- Military personnel: Frequent relocations, short term deployments and irregular pay can create financial instability for service members, making payday loans an attractive option.

- Healthcare workers (e.g. nurses): The demanding nature of their work, along with long shifts and often irregular pay schedules, can result in financial difficulties that payday loans help to address.

- Low-income workers in gig economy jobs: Individuals working in temporary, part-time or gig economy jobs often face inconsistent incomes and may find payday loans helpful in bridging the gap between paychecks, especially when dealing with irregular or delayed payments.

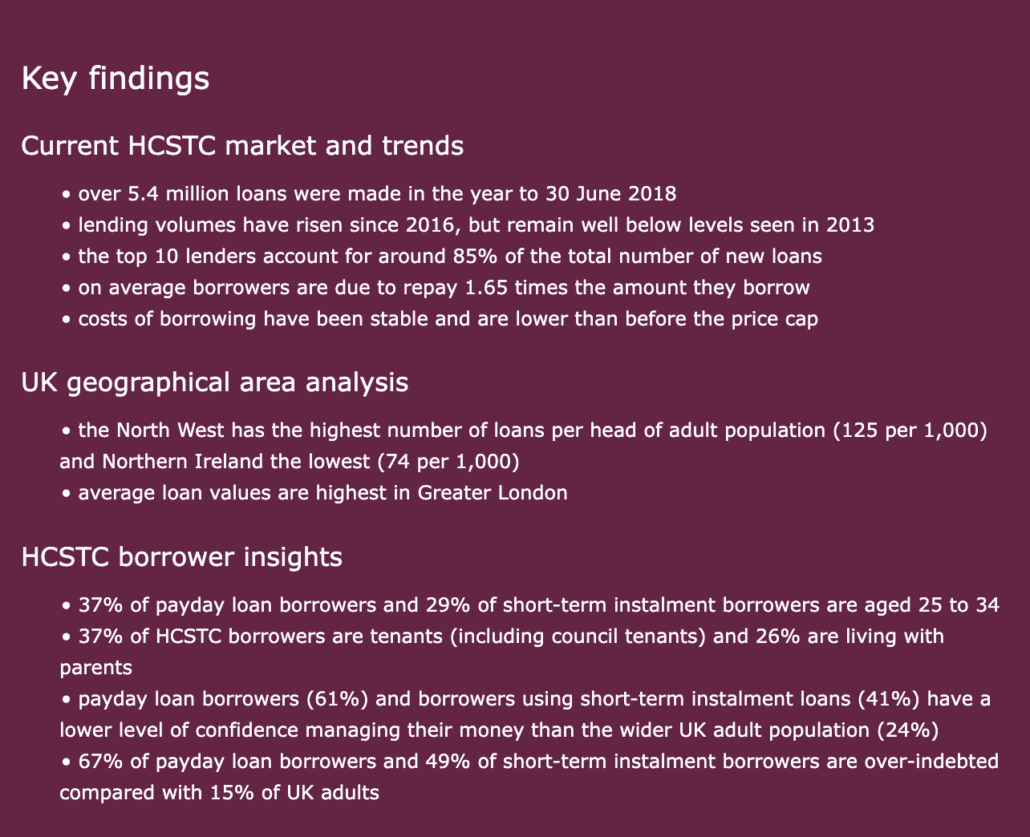

Source: https://www.fca.org.uk/data/consumer-credit-high-cost-short-term-credit-lending-data-jan-2019

Why Do People Choose Payday Loans?

People often turn to payday loans due to the ease and speed with which they can access the funds. The application process is typically simple and the loan can be approved within a matter of hours, providing fast relief for those in urgent need of emergency cash.

This makes payday loans especially appealing to individuals facing short term financial challenges, such as an unexpected medical bill, car repair or an urgent personal matter. In fact, 25% of payday loan users take out loans to cover unexpected emergencies, underscoring the role payday loans play in helping individuals with immediate financial needs.

For many, payday loans are a quick way to bridge the gap between paydays. According to research from the Financial Conduct Authority (FCA), 38% of payday loan users are aged between 25 and 35 years old, highlighting how common this financial product is among young adults who may be living paycheck to paycheck or lack savings and alternative options for quick credit.

This age group is often just starting out in their careers or managing multiple financial responsibilities, making payday loans an attractive option for covering immediate expenses without the long wait of traditional loans.

For those looking to for loans to pay household bills, the opportunity to receive same day funds is very attractive.

What Are The Risks Of Using Payday Loans?

Despite their convenience, payday loans come with significant risks if not managed well. One of the main drawbacks is the high interest rates, which can lead to a debt cycle if the loan is not repaid in full on time.

High interest can quickly snowball, and borrowers who are unable to repay the loan in full may find themselves taking out new loans to cover old ones. This is why it is essential to only take out a payday loan if you are certain that you will be able to comfortably afford the repayments.

Another risk is the potential for long term financial strain. While payday loans offer a short term solution, the financial burden they create can linger.

Many borrowers may find themselves in a continuous cycle of debt, struggling to catch up with payments and often resorting to borrowing more to pay off existing debts. This cycle can significantly damage an individual’s credit score and make it harder to access affordable credit in the future. For any issues, consumers can speak to the Financial Ombudsman Service to discuss their ongoing case.

What Are Alternatives To Payday Loans?

While payday loans may seem like an immediate solution, there are alternatives to payday loans that can provide more sustainable financial relief. For instance, individuals may consider borrowing from family or friends, negotiating with creditors for payment extensions or seeking assistance from charities that provide emergency financial support.

Additionally, many employers now offer payroll advances or financial wellness programs that allow workers to access funds before their payday without resorting to payday loans.

Summary

In conclusion, payday loans are often used by individuals in urgent financial situations, but they come with substantial risks due to their high interest rates and potential to create a cycle of debt.

While they provide a quick solution, it is important to carefully consider the long term consequences and explore other options that might offer more manageable financial support.

Leave a Reply

Want to join the discussion?Feel free to contribute!