Do I Need To Provide Documents To Take Out a Payday Loan?

Last updated on May 15th, 2025 at 03:57 pm

Yes, you may need to provide documents when you apply for a payday loan, although it depends on the lender and their specific requirements.

Many payday lenders will ask for proof of income and employment to confirm your ability to repay the loan. This is usually in the form of a recent payslip or bank statement, which helps the lender assess your financial situation and decide if the loan is affordable for you.

Some lenders will also look at your bank statement to get an idea of your expenses and see if you can affordable a loan without financial trouble.

The goal is to prevent lending to individuals who may not be able to repay the loan and avoid putting them into a cycle of debt.

While the exact documentation required can vary, most reputable payday lenders are obligated to conduct affordability checks, as mandated by the Financial Conduct Authority (FCA). This ensures that they lend responsibly and that borrowers are not pushed into taking on loans they cannot repay.

In some cases, lenders may also request additional documents if they feel it is necessary to verify your financial position, such as proof of address or identification.

What Documents Are Typically Required for Payday Loans?

When applying for a payday loan, the following documents are most commonly requested:

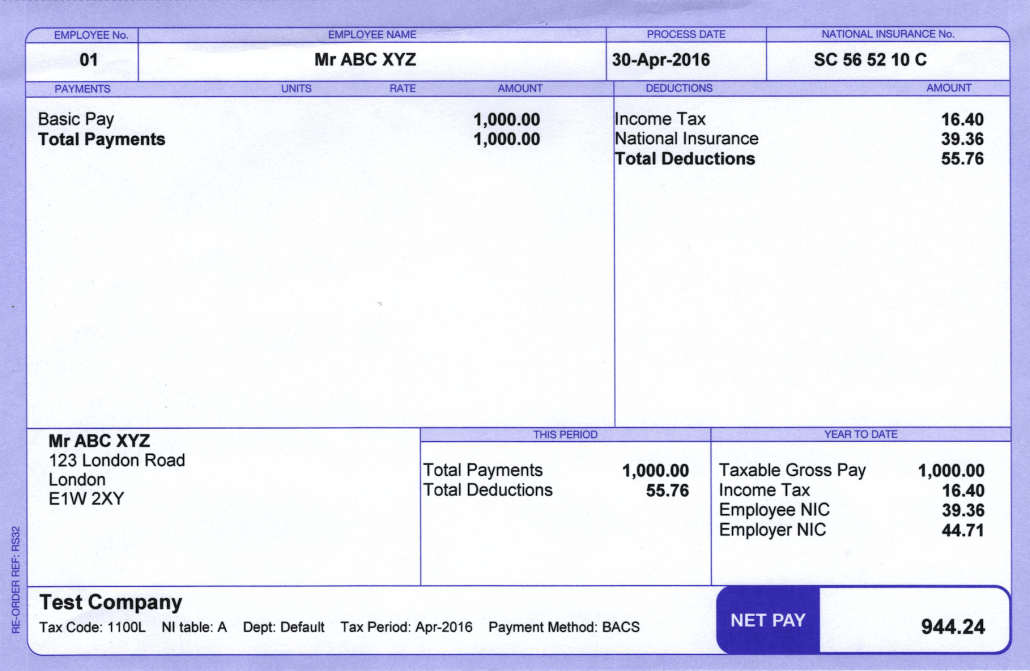

- Payslips: Lenders usually ask for the most recent payslip to confirm your employment and income. This helps them verify that you have a stable income and can afford to repay the loan.

- Bank Statements: Some lenders may ask for recent bank statements (typically from the last 3 months) to assess your spending habits and determine whether you can manage the repayments alongside your existing financial commitments.

- Proof of Identity: In some cases, lenders may require a government-issued ID to confirm your identity and ensure the loan is being taken out by the correct individual.

- Proof of Address: If the lender requires further verification, they may ask for a utility bill or another document to confirm your current address.

These documents are essential for the lender to comply with regulations and ensure that they are not lending to individuals who may struggle to repay the loan.

A lender may request your most recent payslip to confirm your income and up-to-date employment.

Why Do Payday Lenders Require Documents?

Documents offers proof of the real figures when lenders are calculating your income, expenses and confirming your employment status.

Lenders can ensure that the loan is affordable and that you are not being placed in a situation where repayment will become difficult.

So if you want to borrow £900 for instance, the lender’s affordability might determine that it might stretch your financial position based on your income and affordability, and offer you a lower amount such as £500 or £600 instead.

According to the Financial Conduct Authority (FCA) who regulate the payday loan industry, loan providers are legally required to conduct affordability checks, which may involve reviewing your documents to ensure responsible lending.

One statistic from the FCA’s 2020 report indicates that around 3% of payday loan customers experienced payment difficulties, underlining the importance of these checks. Additionally, the same report highlighted that 20% of payday loan customers took out multiple loans, which can indicate potential issues with managing debt if proper documentation and checks are not in place.

Can I Get a Payday Loan Without Documents?

In some cases, there may be short term lenders who do not require documentation upfront, but this is not common. These lenders are often less regulated and may not conduct the thorough checks that are in place to protect both you and them.

Borrowing from unregulated lenders or those who do not ask for documentation can be risky, as it may lead to the loan being unaffordable, which could result in high fees, interest and damage to your credit score. It is always recommended to choose a regulated lender who follows the guidelines set by the Financial Conduct Authority.

What Happens If I Do Not Have the Required Documents?

If you are unable to provide the requested documents, it may be difficult to qualify for a payday loan. The lender will likely be unable to carry out the necessary affordability checks, which could result in the application being declined.

However, if you do not have a payslip or bank statement, some lenders may be flexible and allow you to provide alternative forms of documentation. It is always a good idea to communicate with the lender directly to understand their specific requirements and see if alternative documentation can be used.

Conclusion

While not all payday lenders require documents to approve a loan, many will request proof of income and employment, such as payslips or bank statements, to assess your financial situation and ensure you can afford the loan. This is part of the regulatory requirement to ensure responsible lending practices.

As a borrower, it is important to understand the documentation that may be required and to be prepared to provide accurate and up-to-date information to avoid delays or the rejection of your application. Always ensure that you are borrowing from a reputable and regulated lender to protect your financial wellbeing.

Leave a Reply

Want to join the discussion?Feel free to contribute!