What Are The Typical Customers For Payday Loans in The UK?

Last updated on July 30th, 2025 at 09:49 am

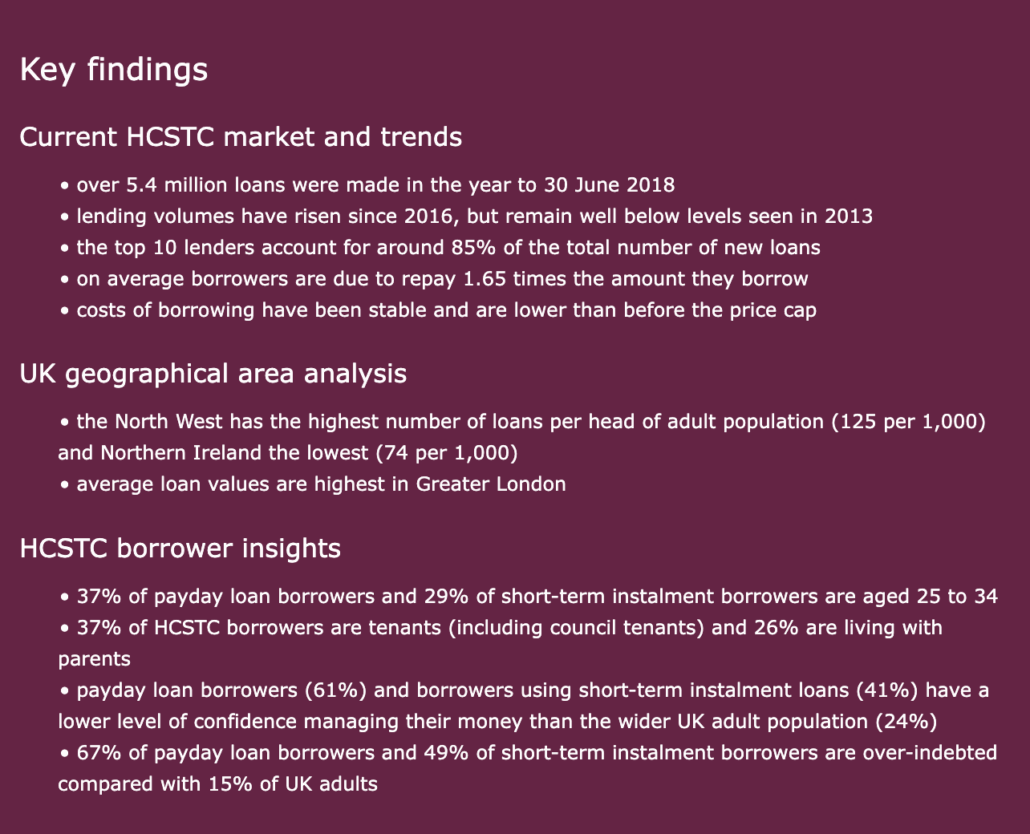

Typically payday loan customers are aged 25-44 years old, an even split between men and women, majority are employed, live in rented accommodation and reside in more urban areas of the UK such as London and Birmingham.

Payday loans are used by more than 1 million Britons each year who cover immediate emergency expenses. With the average loan amount at around £250, this type of product is often used by lower income groups and those who are awaiting their next pay cheque from work.

However, payday loans are not only for lower income groups. Middle class families and working professionals alike can often find themselves overwhelmed with the UK’s cost of living and having to pay for household emergencies.

[lwptoc]

Overview of The Payday Loan Customer Demographic:

| Characteristic | Details |

| Age Range | Most are 25 to 44 years old |

| Average Age | Around 35 years old |

| Income Level | Around two-thirds earn less than £25,000/year |

| Employment Status | Majority are employed, but often in low-income or part-time roles |

| Credit History | Many have poor or limited credit history – see bad credit loans |

| Living Accommodation | 37% are renting, 26% living with parents, less than 10% are homeowners |

| Loan Purpose | Covering essential or emergency expenses (e.g., bills, rent, car repair) See loans to pay for household bills |

| Loan Size | Average loan is around £250–£260 |

| Borrowing Frequency | Many are repeat borrowers, with some taking out multiple loans a year |

| Education Level | Mixed, but often non-university educated |

| Location | Higher usage in urban areas including London, Greater Manchester Birmingham and Blackpool |

What Are The Typical Jobs of Payday Loan Customers?

The main volume of applications for payday loans come from the following:

- Nurses

- Supermarket workers

- Soldiers

- Hospitality workers, waiters and bar staff

- Taxi drivers

However, it is not uncommon to have customers that are professionals including accountants, lawyers, doctors and even footballers.

What Are The Typical Income Levels of Payday Loan Customers?

According to data, around 66% of payday loan customers earn less than £25,000/year. However, there are exceptions where some customers earn more than £50,000 per year and face higher levels of debts.

Source: https://www.fca.org.uk/data/consumer-credit-high-cost-short-term-credit-lending-data-jan-2019

Which Areas Are Typical Payday Loan Customers From?

The North West of England has the highest number of loans per head of adult population (125 per 1,000) including Greater Manchester and Lancashire. The higher number of applications come from London (circa 15%). Other popular areas for payday loan customers include Birmingham, Glasgow, Newcastle and Sheffield.

How Many People Use Payday Loans in The UK?

There are in the region of 1 million to 1.5 million Britons that use payday loans in the UK each year. Many customers are repeat customers taking out multiple loans per year – and the regulator and lenders are obliged to limit repeat borrowing where possible.

This number of borrowers has decreased in recent years following the strict introduction of regulation by the FCA in 2015.

Prior to this regulation, the number of payday loan customers in the UK was considered to be higher, with 10 million active loans reported in 2013, as a result of customers allowed to take out multiple loans at once and borrow repeatedly. month-after-month.

How Many Payday Lenders Are There in The UK?

There are less than 50 payday lenders in the UK as of 2025. Before regulation was introduced, there were more than 200 active lenders, many of whom were removed or voluntarily shut down when new regulation was introduced.

What is The Payday Loans Industry Worth in the UK Today?

The latest figure is that the payday loans market in the UK is worth around £2 billion in 2020. However, following stricter lending laws by the FCA, some would value the industry today at less than £1 billion.

Leave a Reply

Want to join the discussion?Feel free to contribute!