Why Is the APR for Payday Loans So High?

Estimated reading time: 5 minutes

Last updated on November 21st, 2025 at 04:23 pm

Payday loans have high APRs because a loan which typically lasts a few weeks or months is compounded multiple times to show the APR as if the product was being taken out for a year. In addition, payday loans carry higher interest rates than typical loans because they offer loans for people with bad credit and have high default rates – so the fees are used to offset the missed payments.

In short, the APR for payday loans are high because:

- Loans are offered to people with adverse credit or sub prime – making them high risk for lenders

- The loans are a few weeks but calculated to show an APR as an annual product – as required by the FCA

- Loans are provided quick, within hours or the same day – adding admin costs

- Lenders have high costs including licenses, credit checks and same day payment facilities.

The Financial Conduct Authority (FCA) explains how high-cost short-term credit is regulated, including the caps that limit what lenders can charge.

How Does APR Work?

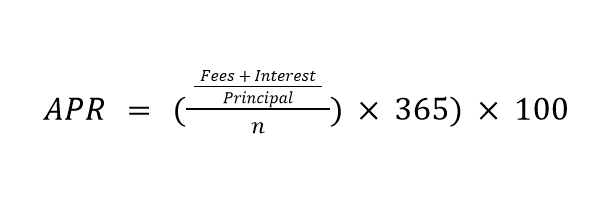

APR is the annual percentage rate, which is used as an easy benchmark and comparison to show the cost of financial products including loans, credit cards, car finance, mortgages and more.

APR stretches the cost of a short-term loan across a full 12-month period, which can make a small fee look like a huge percentage. For example, paying £15 to borrow £100 for 30 days can create an APR of over 300%, even though the actual cost to you is only £15. MoneyHelper breaks down how APR is calculated on short-term loans and why the figure can be misleading for products meant to be repaid quickly.

Below, we break down why payday loan APRs appear so high, how the calculations work, and what the FCA’s rules mean for anyone considering this type of borrowing.

What Does APR Mean For Payday Loans?

APR for payday loans is the annualised cost of borrowing, even though payday loans are meant to be repaid within weeks or months. The figure includes interest and any mandatory fees, and it stretches the cost out over a full year.

This is why payday loan APRs often look shockingly high — sometimes over 1,000% — but the actual cost paid over a short term is far lower in real pounds and pence. APR isn’t a perfect measure for short-term credit, but lenders are legally required to display it so customers can compare products.

What Factors Cause Payday Loan APRs To Be So High?

Payday loan APRs are high because the lender takes on more risk, processes applications quickly, and manages smaller loan amounts that are more expensive to administer.

Payday lenders generally serve customers who:

- Have lower credit scores

- Have limited borrowing options

- Need money quickly

- Are more likely to miss payments

Faster approval + higher risk + small loan sizes = higher costs, which show up as a large APR.

How Does The APR For Payday Loans Compare To Other Products?

| Product | Typical APR (UK) | Typical Loan Amounts | Monthly / Daily Interest Equivalent |

|---|---|---|---|

| Payday Loans | Around 1,000%+ APR | Usually £50–£1,000, short-term | Capped at 0.8% per day (FCA cap) |

| Credit Cards | Typically 22%–36% APR | Varies by limit, often £1,000s | Roughly 1.8%–3% per month |

| Unsecured Personal Loans | Usually 3%–30% APR, depending on credit and loan size | Commonly £1,000–£25,000+ | Around 0.5%–2.5% per month |

| Credit Unions | Typically circa 12% APR | Usually small-to-medium loans | Around 1% per month |

| Car Finance | Commonly 6%–16% APR depending on credit profile | Often from £1,000 up to tens of thousands | Around 0.5%–1.5% per month |

| Mortgages | Generally 3%–6% APRC depending on market conditions | Usually £50,000 to £500,000+ | Around 0.3%–0.8% per month |

How Do Short Terms And Small Loan Amounts Affect The APR?

Short terms and small loan amounts dramatically inflate the APR because the calculation assumes the loan lasts for a full year. If you borrow £100 and pay a £15 fee to borrow it for 30 days, your APR is over 300%, but you’re only actually paying £15, not hundreds of pounds.

If the same £15 were spread over an entire year, the APR would look tiny. Because payday loans are short-term, the APR ratio becomes distorted.

Why Do Payday Lenders Take On Higher-Risk Borrowers?

Payday loans direct lenders take on borrowers that mainstream banks often decline, which means the risk of missed or late payments is higher. To cover those losses, payday lenders build that risk into the cost of borrowing.

These lenders also approve loans quickly (often within minutes) without long income assessments, which increases their exposure. Higher risk always leads to higher pricing in lending.

How Does Regulation Influence Payday Loan Pricing?

Regulation has tightened payday loan pricing significantly since the FCA introduced price caps. Today, lenders must stick to strict rules:

- A total cost cap of 100% (you never repay more in interest and fees than the amount you borrowed)

- A daily interest cap of 0.8%

- A £15 cap on default fees

While these rules protect borrowers, they also limit how lenders structure costs. The result is a higher APR but a capped overall repayment amount.

Can A High APR Still Make Sense In Certain Situations?

A high APR can make sense if the total repayment is affordable and the loan helps you manage a short-term problem. Remember: payday loans are not long-term products. What matters most is the total cost, not the headline APR.

For example, borrowing £150 and repaying £180 might be expensive, but it’s still a fixed £30 cost, not hundreds or thousands. APR exaggerates the number because it assumes you keep the loan for a full year.

What Alternatives Are There To High APR Payday Loans?

There are several alternatives that may cost far less:

- Credit unions

- Budgeting loans (if on certain benefits)

- Overdrafts or low-limit credit cards

- Speaking to lenders about repayment plans

- Local welfare or emergency assistance schemes

These types of loans won’t suit everyone, but they’re worth exploring before turning to high-cost credit.

The APR on payday loans looks high because the calculation isn’t designed for short-term borrowing, and because lenders take on higher-risk customers who need money fast. What matters is the total cost, the repayment cap, and whether the loan is genuinely affordable. If you’re unsure, compare rates and think carefully before borrowing — or explore lower-cost alternatives that may be available to you.

Leave a Reply

Want to join the discussion?Feel free to contribute!